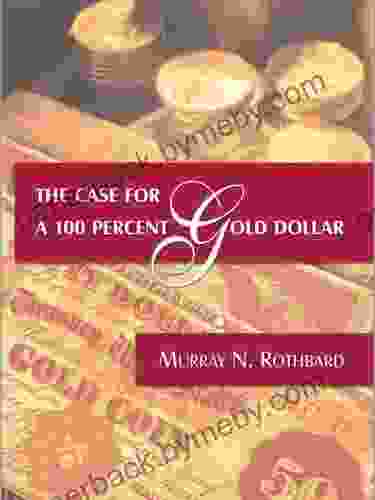

Unlocking Financial Stability: The Case for 100 Percent Gold Dollar

In the ever-evolving realm of finance, the question of monetary stability remains at the forefront of economic discourse. Amidst the complexities of our modern financial system, many experts advocate for a return to a simpler, more secure foundation: the 100 percent gold dollar. This comprehensive article delves into the compelling arguments presented in the groundbreaking book "The Case for 100 Percent Gold Dollar," exploring the transformative potential of this monetary paradigm shift.

At the crux of the argument for a gold-backed dollar lies the volatility inherent in fiat currencies. Unbacked by any physical asset, the value of fiat currencies is subject to the whims of monetary policy, economic fluctuations, and political instability. As governments resort to quantitative easing and deficit spending, the purchasing power of fiat currencies erodes, leading to inflation and a loss of trust in the monetary system.

In contrast to the volatility of fiat currencies, gold has proven to be a reliable store of value for centuries. Its scarcity, durability, and universal recognition make it an ideal medium of exchange and a safe haven asset during times of uncertainty. Unlike fiat currencies, which can be inflated at will, the supply of gold is limited, ensuring its long-term purchasing power.

4.2 out of 5

| Language | : | English |

| File size | : | 225 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

Throughout history, economies anchored by gold have experienced greater stability and prosperity. From the gold standard era of the 19th century to the post-World War II Bretton Woods system, gold-backed currencies have fostered economic growth, low inflation, and a sound monetary environment. By eliminating the temptation for governments to manipulate the money supply, a gold standard promotes fiscal discipline and responsible economic policies.

One of the key concerns often raised against a gold standard is its potential to constrain economic growth and lead to deflation. However, historical evidence suggests that this is not necessarily the case. During the gold standard era, economies experienced periods of both expansion and contraction, but the overall trend was one of sustained growth. Furthermore, the limited supply of gold acts as a natural check against excessive inflation, ensuring that prices remain relatively stable over the long term.

In a 100 percent gold dollar system, the role of central banks would be significantly reduced. Instead of managing the money supply through interest rate manipulation and quantitative easing, central banks would focus primarily on maintaining the gold standard and ensuring the stability of the financial system. This shift would limit the ability of governments to engage in inflationary policies and would promote a more independent and transparent monetary framework.

While the arguments for a gold-backed dollar are compelling, practical concerns must be addressed. One concern is the potential for gold manipulation or hoarding, which could disrupt the stability of the system. However, robust safeguards and market mechanisms can be implemented to mitigate these risks. Additionally, the adoption of fractional reserve banking, where banks hold only a fraction of their deposits in gold, can help accommodate economic growth without requiring a proportional increase in the gold supply.

The implementation of a 100 percent gold dollar would require international cooperation and coordination. A global agreement on the gold price, exchange rates, and the rules governing the system would be necessary to ensure its stability and widespread adoption. However, the potential benefits of a sound and universally accepted monetary system would outweigh the challenges associated with international cooperation.

The case for a 100 percent gold dollar is a compelling one, offering a path towards greater financial stability, reduced inflation, and increased economic freedom. By eliminating the volatility inherent in fiat currencies and anchoring the value of money in a tangible asset, a gold standard can provide a solid foundation for sustained economic growth and prosperity. As we navigate an increasingly complex and uncertain financial landscape, it is imperative that we consider the transformative potential of a return to sound monetary principles.

Embrace the transformative potential of the 100 percent gold dollar by reading "The Case for 100 Percent Gold Dollar." This groundbreaking book provides an in-depth analysis of the arguments for a gold standard, offering a roadmap for a more stable and prosperous future. Together, we can advocate for a monetary system that protects our wealth, preserves our economic freedom, and secures a brighter tomorrow for generations to come.

- Alt Text 1: A close-up image of a gold coin, symbolizing the stability and purchasing power of gold.

- Alt Text 2: A graph showing the historical inflation rate of fiat currencies, highlighting their volatility and tendency to lose value over time.

- Alt Text 3: An image of a central bank building, representing the potential reduction in central bank power under a gold standard.

- Alt Text 4: A group of people from different countries holding hands, symbolizing the need for international cooperation in implementing a global gold standard.

4.2 out of 5

| Language | : | English |

| File size | : | 225 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Kirstin Dow

Kirstin Dow Phil G Tang

Phil G Tang Ken Venturi

Ken Venturi Olga Baranova

Olga Baranova Kevin Bupp

Kevin Bupp Programming Languages Academy

Programming Languages Academy Kerri Maniscalco

Kerri Maniscalco Lee Jackson

Lee Jackson Peter Lane

Peter Lane Laila Ibrahim

Laila Ibrahim Kevin Milton

Kevin Milton William Esper

William Esper Kim Heacox

Kim Heacox Seabury Blair

Seabury Blair Ken Shamrock

Ken Shamrock Ron Miner

Ron Miner H Bruce Franklin

H Bruce Franklin Nicholas Marsh

Nicholas Marsh Khenchen Thrangu

Khenchen Thrangu Major T Benton

Major T Benton

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Russell MitchellGateway to the Himalayas: Discover the Enchanting Charms of Himachal Pradesh

Russell MitchellGateway to the Himalayas: Discover the Enchanting Charms of Himachal Pradesh Ivan TurgenevFollow ·13.9k

Ivan TurgenevFollow ·13.9k J.D. SalingerFollow ·15.1k

J.D. SalingerFollow ·15.1k Bruce SnyderFollow ·3.1k

Bruce SnyderFollow ·3.1k Vladimir NabokovFollow ·4.6k

Vladimir NabokovFollow ·4.6k Henry Wadsworth LongfellowFollow ·14.2k

Henry Wadsworth LongfellowFollow ·14.2k Adrien BlairFollow ·16.4k

Adrien BlairFollow ·16.4k José MartíFollow ·14.6k

José MartíFollow ·14.6k Dakota PowellFollow ·2k

Dakota PowellFollow ·2k

Isaac Asimov

Isaac AsimovEmbark on an Epic Adventure: The Colorado Trail 9th...

Unveiling the Treasures of the Colorado...

Clinton Reed

Clinton ReedUltimate Football Heroes: Uncover the Gridiron Greatness...

Enter the World...

Ibrahim Blair

Ibrahim BlairUnveiling the Secrets of Stolen Focus: A Journey to...

In today's relentless digital...

Colt Simmons

Colt SimmonsRediscover the Founding Father's Vision: Thomas Jefferson...

Immerse Yourself in the Unedited Words of...

Juan Butler

Juan ButlerExcel in Language Learning: The Ultimate Self-Study...

Unlock Your Language Potential with Our...

4.2 out of 5

| Language | : | English |

| File size | : | 225 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 75 pages |

| Lending | : | Enabled |