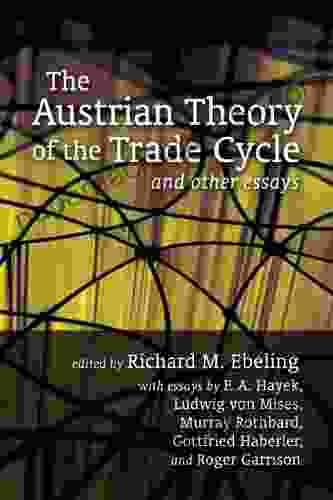

The Austrian Theory of the Trade Cycle and Other Essays: A Comprehensive Overview

4.7 out of 5

| Language | : | English |

| File size | : | 635 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 130 pages |

| Lending | : | Enabled |

Ludwig von Mises's seminal work, 'The Austrian Theory of the Trade Cycle and Other Essays', published in 1912, is a foundational text in the field of economics. It presents a comprehensive and rigorous analysis of the causes and consequences of economic crises, offering a unique perspective that has had a profound influence on economic thought and policy. This article provides a comprehensive overview of the Austrian Theory of the Trade Cycle, exploring its key concepts, implications for economic policy, and relevance for understanding contemporary economic issues.

Key Concepts of the Austrian Theory of the Trade Cycle

The Austrian Theory of the Trade Cycle is based on the idea that economic crises are caused by monetary factors, particularly the expansion of credit. When banks and other financial institutions create new credit, they effectively increase the supply of money in the economy. This leads to a temporary boom in economic activity, as businesses and consumers borrow money to invest and spend.

However, this boom is unsustainable, as the new money is not backed by real economic growth. Instead, it leads to malinvestment, as businesses and consumers invest in projects that would not be profitable in a free market. This malinvestment creates imbalances in the economy, which eventually lead to a crisis.

The crisis occurs when the boom ends and the new money is withdrawn from the economy. This causes a sharp decline in economic activity, as businesses and consumers are forced to cut back on their spending. The crisis can be exacerbated by a loss of confidence in the financial system, which can lead to a run on banks and a collapse in lending.

The Role of Sound Money

Mises believed that the key to preventing economic crises is to maintain a sound monetary system. A sound monetary system is one in which the money supply is not subject to arbitrary manipulation by the government or central bank. Instead, the money supply should be determined by the free market, through the interaction of supply and demand.

Mises argued that a sound monetary system would help to prevent economic crises by limiting the ability of banks to create new credit. When the government or central bank can arbitrarily increase the money supply, it creates an incentive for banks to lend money recklessly. This can lead to a boom in economic activity that is unsustainable and will eventually end in a crisis.

Implications for Economic Policy

The Austrian Theory of the Trade Cycle has important implications for economic policy. First, it suggests that the government should avoid interfering in the free market. The government should not try to artificially stimulate the economy through monetary or fiscal policy. Instead, it should focus on creating a sound monetary system and allowing the economy to self-correct.

Second, the Austrian Theory of the Trade Cycle highlights the importance of sound banking practices. Banks should be required to hold sufficient capital to cover potential losses and should not be allowed to engage in risky lending practices. This will help to prevent the creation of new credit that can lead to economic crises.

Relevance for Contemporary Economic Issues

The Austrian Theory of the Trade Cycle remains relevant for understanding contemporary economic issues. The theory helps to explain the causes of the financial crisis of 2008, which was triggered by a housing bubble that was caused by excessive credit creation. The theory also helps to explain the slow recovery from the financial crisis, as the government's response to the crisis has led to even more credit creation and malinvestment.

The Austrian Theory of the Trade Cycle offers valuable insights into the causes and consequences of economic crises. By understanding the theory, we can better develop policies to prevent future crises and promote sustainable economic growth.

Ludwig von Mises's 'The Austrian Theory of the Trade Cycle and Other Essays' is a seminal work in the field of economics. It presents a comprehensive and rigorous analysis of the causes and consequences of economic crises, offering a unique perspective that has had a profound influence on economic thought and policy. The theory's insights into the role of credit expansion, malinvestment, and sound money remain relevant for understanding contemporary economic issues and developing policies to promote sustainable economic growth.

4.7 out of 5

| Language | : | English |

| File size | : | 635 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 130 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Lucie B Amundsen

Lucie B Amundsen Kevin Greene

Kevin Greene Kev Partridge

Kev Partridge William Gerin

William Gerin Kids Activity Time Publishing

Kids Activity Time Publishing Malcolm Mackenzie

Malcolm Mackenzie Steve Ramirez

Steve Ramirez Kevin Lane Dearinger

Kevin Lane Dearinger Prakruti Prativadi

Prakruti Prativadi Kevin Shea

Kevin Shea Sydney L Iaukea

Sydney L Iaukea Kimberly Willis

Kimberly Willis Jessie Hartland

Jessie Hartland Neil Simpson

Neil Simpson Kianna Alexander

Kianna Alexander Phil Thornton

Phil Thornton Kevin Neary

Kevin Neary Kevin Stiegelmaier

Kevin Stiegelmaier Mulk Raj Anand

Mulk Raj Anand Steven Charleston

Steven Charleston

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Desmond FosterFollow ·19.5k

Desmond FosterFollow ·19.5k Cody BlairFollow ·9.4k

Cody BlairFollow ·9.4k Gage HayesFollow ·2.2k

Gage HayesFollow ·2.2k Peter CarterFollow ·18.6k

Peter CarterFollow ·18.6k Craig BlairFollow ·7.2k

Craig BlairFollow ·7.2k Guillermo BlairFollow ·11.1k

Guillermo BlairFollow ·11.1k Haruki MurakamiFollow ·3.8k

Haruki MurakamiFollow ·3.8k Jedidiah HayesFollow ·11.5k

Jedidiah HayesFollow ·11.5k

Isaac Asimov

Isaac AsimovEmbark on an Epic Adventure: The Colorado Trail 9th...

Unveiling the Treasures of the Colorado...

Clinton Reed

Clinton ReedUltimate Football Heroes: Uncover the Gridiron Greatness...

Enter the World...

Ibrahim Blair

Ibrahim BlairUnveiling the Secrets of Stolen Focus: A Journey to...

In today's relentless digital...

Colt Simmons

Colt SimmonsRediscover the Founding Father's Vision: Thomas Jefferson...

Immerse Yourself in the Unedited Words of...

Juan Butler

Juan ButlerExcel in Language Learning: The Ultimate Self-Study...

Unlock Your Language Potential with Our...

4.7 out of 5

| Language | : | English |

| File size | : | 635 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 130 pages |

| Lending | : | Enabled |